Weekly SPY (US500-ES-SPX) Outlook - Prediction (16 NOV)

📊 Market Sentiment

Market sentiment appears bearish right now, in my opinion. The FED may pause rate cuts in December, which has contributed to recent selling pressure and potential hedging flows. However, with the U.S. government reopening last week, we will begin receiving updated economic data again. If employment data weakens and CPI comes in low or stable, it could support renewed bullish momentum.

NVDA will report earnings this Wednesday after market close. I will be watching closely in my view, if NVDA were to miss expectations, both QQQ and SPY could see a strong retracement. However, I think this is unlikely. I expect solid earnings growth and believe the ongoing AI cycle will continue to support upside.

Additionally, U.S. Treasury Secretary Scott Bessent stated that the Trump administration aims to finalize its trade agreement with China by Thanksgiving (November 27). This could help bring additional bullish sentiment into the market.

📈 Technical Analysis

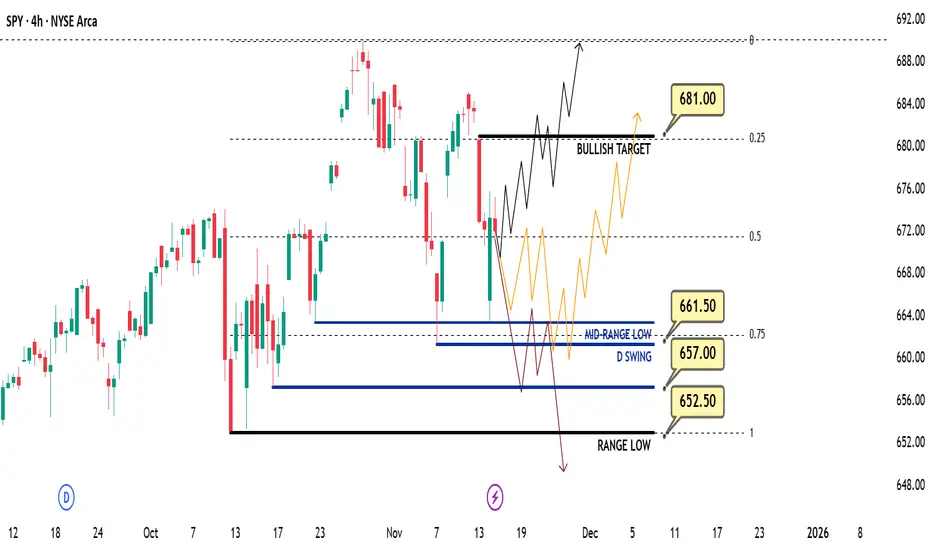

Price retraced into the 0.75 max discount zone, ran the mid-term range low, and closed back above it creating another higher expansion bounce. On Friday, we saw a second retest of the range low followed by another strong reaction. In my opinion, price remains strong here.

📌 Game Plan – Prediction

I currently see three scenarios:

Bullish Scenario (Black Line):

I believe this is the most likely scenario. I want to see price close above 675.5 and continue expanding higher. The first bullish target is 681. After clearing 681, a small retracement may occur, followed by a potential expansion toward all-time highs around 690.

Orange Scenario:

If the market opens less bullish on Sunday night, price may run 661 to gather more liquidity and energy for a move higher. If 661 is swept and a 4H candle closes back above it, I will assume this scenario is playing out.

Bearish Scenario (Red Line):

If price breaks aggressively below 661 and closes underneath it, that would indicate the market may want to move lower. In that case, I will exit my calls and buy puts, targeting a move toward at least 562.5.

💬 For detailed insights and broader market context, please check my Substack link in profile.

⚠️ For educational purposes only. This is not financial advice.

📊 Market Sentiment

Market sentiment appears bearish right now, in my opinion. The FED may pause rate cuts in December, which has contributed to recent selling pressure and potential hedging flows. However, with the U.S. government reopening last week, we will begin receiving updated economic data again. If employment data weakens and CPI comes in low or stable, it could support renewed bullish momentum.

NVDA will report earnings this Wednesday after market close. I will be watching closely in my view, if NVDA were to miss expectations, both QQQ and SPY could see a strong retracement. However, I think this is unlikely. I expect solid earnings growth and believe the ongoing AI cycle will continue to support upside.

Additionally, U.S. Treasury Secretary Scott Bessent stated that the Trump administration aims to finalize its trade agreement with China by Thanksgiving (November 27). This could help bring additional bullish sentiment into the market.

📈 Technical Analysis

Price retraced into the 0.75 max discount zone, ran the mid-term range low, and closed back above it creating another higher expansion bounce. On Friday, we saw a second retest of the range low followed by another strong reaction. In my opinion, price remains strong here.

📌 Game Plan – Prediction

I currently see three scenarios:

Bullish Scenario (Black Line):

I believe this is the most likely scenario. I want to see price close above 675.5 and continue expanding higher. The first bullish target is 681. After clearing 681, a small retracement may occur, followed by a potential expansion toward all-time highs around 690.

Orange Scenario:

If the market opens less bullish on Sunday night, price may run 661 to gather more liquidity and energy for a move higher. If 661 is swept and a 4H candle closes back above it, I will assume this scenario is playing out.

Bearish Scenario (Red Line):

If price breaks aggressively below 661 and closes underneath it, that would indicate the market may want to move lower. In that case, I will exit my calls and buy puts, targeting a move toward at least 562.5.

💬 For detailed insights and broader market context, please check my Substack link in profile.

⚠️ For educational purposes only. This is not financial advice.

עסקה סגורה: היעד הושג

SPY weekly prediction played out perfectly.The bearish scenario worked exactly as expected we first ran 657 and bounced, moved back to 671 and rejected, then expanded lower toward 625.5. From there, we saw a strong Friday bounce and closed back above 625.

Follow me for weekly and daily QQQ/SPY analysis.

פרסומים קשורים

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

פרסומים קשורים

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.