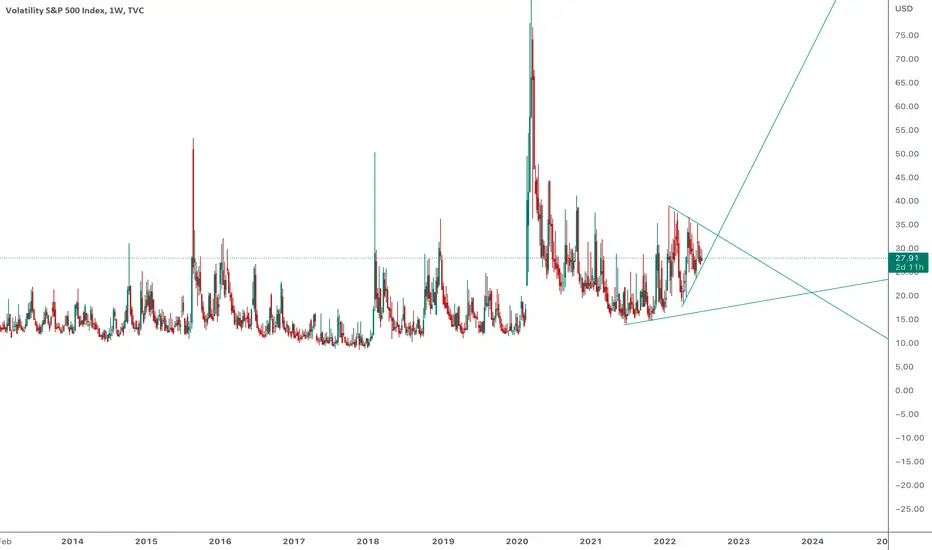

As the VIX continues in a flag pattern since January 2022, a few observations can be made:

At the height of the maximization of the the VIX following the Ukraine invasion, the VIX was still lower than the level it reached when the COVID headwinds hit the markets. This shows that the shock of the invasion and its expected impact was lower than that of COVID.

The markets were tired of bad news, were more weary than shocked.

As the Ukraine war drags on, and the fears of a global recession increases, we are unlikely to see a sudden increase in volatility. Russia lacks the desire and most probably the capability to take the NATO alliance head on. So we will only witness subterfuge and non symmetric warfare between the two blocks in the given future. When the Volatility needs to break out of the flag pattern, its subsequent direction will depend on any black swan shocks to the system. If a military conflict breaks out between NATO and Russia or the US and China, then we will see an upswing in volatility, otherwise we will see volatility falling down.

With a decrease in volatility and increase in the DXY, we will also see a decrease in the price of Gold, BTC and other 'value holding assets'. The price of Oil will be more in line with the demands from the economy. The price of Gas is in line with the Demand & Supply of LNG across the globe. The value of commodities are no longer moving in unison.

The world is in an interesting economic place and this is giving us many interesting trading opportunities.

I will follow this post with more analysis. Stay posted and any comments or debates are welcome.

At the height of the maximization of the the VIX following the Ukraine invasion, the VIX was still lower than the level it reached when the COVID headwinds hit the markets. This shows that the shock of the invasion and its expected impact was lower than that of COVID.

The markets were tired of bad news, were more weary than shocked.

As the Ukraine war drags on, and the fears of a global recession increases, we are unlikely to see a sudden increase in volatility. Russia lacks the desire and most probably the capability to take the NATO alliance head on. So we will only witness subterfuge and non symmetric warfare between the two blocks in the given future. When the Volatility needs to break out of the flag pattern, its subsequent direction will depend on any black swan shocks to the system. If a military conflict breaks out between NATO and Russia or the US and China, then we will see an upswing in volatility, otherwise we will see volatility falling down.

With a decrease in volatility and increase in the DXY, we will also see a decrease in the price of Gold, BTC and other 'value holding assets'. The price of Oil will be more in line with the demands from the economy. The price of Gas is in line with the Demand & Supply of LNG across the globe. The value of commodities are no longer moving in unison.

The world is in an interesting economic place and this is giving us many interesting trading opportunities.

I will follow this post with more analysis. Stay posted and any comments or debates are welcome.

פרסומים קשורים

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.

פרסומים קשורים

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.