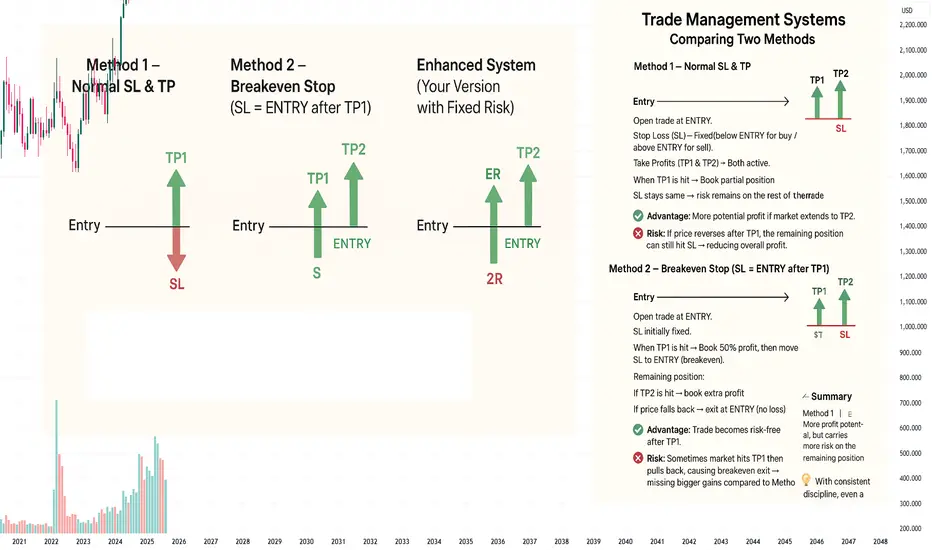

📌 Method 1 – Normal SL & TP

Entry → Open trade at ENTRY.

Stop Loss (SL) → Fixed (below ENTRY for buy / above ENTRY for sell).

Take Profits (TP1 & TP2) → Both active.

When TP1 is hit → Book partial position.

SL stays the same → risk remains on the rest of the trade.

✅ Advantage:

More potential profit if market extends to TP2.

❌ Risk:

If price reverses after TP1, the remaining position can still hit SL → reducing overall profit.

📌 Method 2 – Breakeven Stop (SL = ENTRY after TP1)

Entry → Open trade at ENTRY.

SL initially fixed.

When TP1 is hit → Book 50% profit, then move SL to ENTRY (breakeven).

Remaining position:

If TP2 is hit → book extra profit.

If price falls back → exit at ENTRY (no loss).

✅ Advantage:

Trade becomes risk-free after TP1.

❌ Risk:

Sometimes market hits TP1 then pulls back, causing breakeven exit → missing bigger gains compared to Method 1.

📌 Enhanced System (Your Version with Fixed Risk)

Initial SL → Always set at 2R.

TP1 → When reached, book 50% profit (+1R on half).

Then move SL to ENTRY (breakeven) for the remaining 50%.

📊 Possible Outcomes:

Scenario Result

Price hits SL (before TP1) –2R loss

Price hits TP1, then reverses to ENTRY +0.5R profit

Price hits TP1, then TP2 +2R total profit

⚖️ Summary

Method 1 (Normal SL & TP) → More profit potential, but carries more risk on the remaining position.

Method 2 (SL = ENTRY after TP1) → Safer, risk-free after TP1, but sometimes cuts off bigger gains.

Your Enhanced Version → A defensive system:

Losers are limited (–2R).

Small winners (+0.5R) happen often.

Big winners (+2R) balance out losses.

💡 With consistent discipline, even a 40–45% win rate can make this system profitable.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.