OPEN-SOURCE SCRIPT

מעודכן FibExtender [tradeviZion]

FibExtender [tradeviZion]: A Guide to Identifying Resistance with Fibonacci Levels

Introduction

Fibonacci levels are essential tools in technical analysis, helping traders identify potential resistance and support zones in trending markets. FibExtender [tradeviZion] is designed to make this analysis accessible to traders at all levels, especially beginners, by automating the process of plotting Fibonacci extensions. With FibExtender, you can visualize potential resistance levels quickly, empowering you to make more informed trading decisions without manually identifying every pivot point. In this article, we’ll explore how FibExtender works, guide you step-by-step in using it, and share insights for both beginner and advanced users.

What is FibExtender [tradeviZion]?

FibExtender [tradeviZion] is an advanced tool that automates Fibonacci extension plotting based on significant pivot points in price movements. Fibonacci extensions are percentages based on prior price swings, often used to forecast potential resistance zones where price might reverse or consolidate. By automatically marking these Fibonacci levels on your chart, FibExtender saves time and reduces the complexity of technical analysis, especially for users unfamiliar with calculating and plotting these levels manually.

FibExtender not only identifies Fibonacci levels but also provides a customizable framework where you can adjust anchor points, colors, and level visibility to suit your trading strategy. This customization allows traders to tailor the indicator to fit different market conditions and personal preferences.

Key Features of FibExtender

FibExtender offers several features to make Fibonacci level analysis easier and more effective. Here are some highlights:

Step-by-Step Guide for Beginners

Let’s walk through how to use the FibExtender [tradeviZion] script on a TradingView chart. This guide will ensure that you’re able to set it up and interpret the key information displayed by the indicator.

Step 1: Adding FibExtender to Your Chart

Step 2: Customizing Fibonacci Levels

Step 3: Spotting Visual Clusters (Manual Analysis)

Step 4: Observing the Price Action Around Fibonacci Levels

Advanced Insights (for Intermediate to Advanced Users)

For users interested in the technical workings of FibExtender, this section provides insights into how the indicator functions on a code level.

Pivot Point and Swing Detection

FibExtender uses a pivot-high and pivot-low detection function to identify significant price points. The upFractal and dnFractal variables detect these levels based on recent highs and lows, creating the basis for Fibonacci extension calculations. Here’s an example of the code used for this detection:

Pine Script®

By setting the number of periods for n, users can adjust the sensitivity of the script to recent price swings.

Fibonacci Level Calculation

The following function calculates the Fibonacci levels based on the selected pivot points and applies each level’s specific ratio (e.g., 0.618, 1.618) to project extensions above the recent price swing.

Pine Script®

This function iterates over each level enabled by the user, calculating extensions by multiplying the price range by the corresponding Fibonacci ratio.

Example Use Case: Identifying Resistance in Microsoft (MSFT)

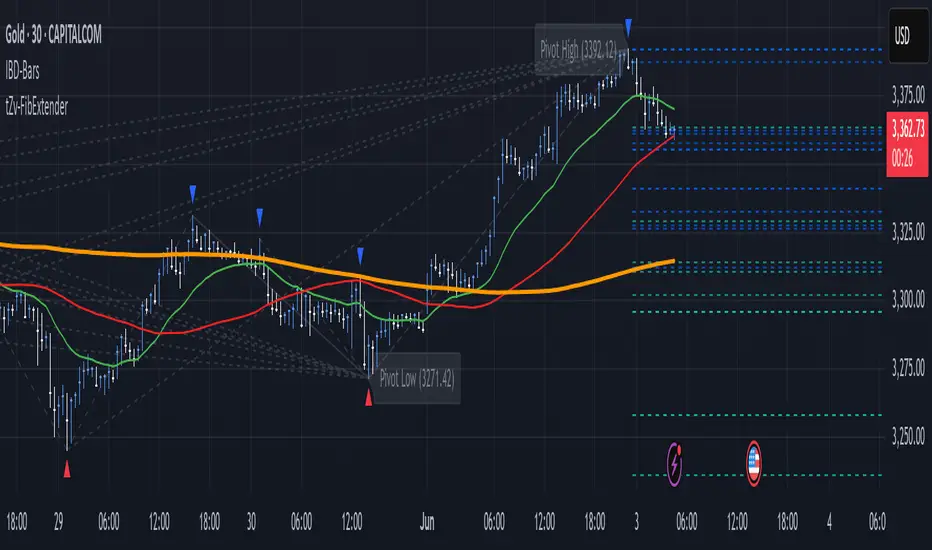

To better understand how FibExtender highlights resistance, let’s look at Microsoft’s stock chart (MSFT), as shown in the image. The chart displays several Fibonacci levels extending upward from a recent pivot low around $408.17. Here’s how you can interpret the chart:

Conclusion: Harnessing Fibonacci Extensions with FibExtender

FibExtender [tradeviZion] is a powerful tool for identifying potential resistance levels without the need for manual Fibonacci calculations. It automates the detection of key swing points and projects Fibonacci extensions, offering traders a straightforward approach to spotting potential resistance zones. For beginners, FibExtender provides a user-friendly gateway to technical analysis, helping you visualize levels where price may react.

For those with a bit more experience, the indicator offers insight into pivot points and Fibonacci calculations, enabling you to fine-tune the analysis for different market conditions. By carefully observing price reactions around clustered levels, users can identify areas of stronger resistance and refine their trade management strategies accordingly.

FibExtender is not just a tool but a framework for disciplined analysis. Using Fibonacci levels for guidance can support your trading decisions, helping you recognize areas where price might struggle or reverse. Integrating FibExtender into your trading strategy can simplify the complexity of Fibonacci extensions and enhance your understanding of resistance dynamics.

Note: Always practice proper risk management and thoroughly test the indicator to ensure it aligns with your trading strategy. Past performance is not indicative of future results.

Trade smarter with TradeVizion—unlock your trading potential today!

Introduction

Fibonacci levels are essential tools in technical analysis, helping traders identify potential resistance and support zones in trending markets. FibExtender [tradeviZion] is designed to make this analysis accessible to traders at all levels, especially beginners, by automating the process of plotting Fibonacci extensions. With FibExtender, you can visualize potential resistance levels quickly, empowering you to make more informed trading decisions without manually identifying every pivot point. In this article, we’ll explore how FibExtender works, guide you step-by-step in using it, and share insights for both beginner and advanced users.

What is FibExtender [tradeviZion]?

FibExtender [tradeviZion] is an advanced tool that automates Fibonacci extension plotting based on significant pivot points in price movements. Fibonacci extensions are percentages based on prior price swings, often used to forecast potential resistance zones where price might reverse or consolidate. By automatically marking these Fibonacci levels on your chart, FibExtender saves time and reduces the complexity of technical analysis, especially for users unfamiliar with calculating and plotting these levels manually.

FibExtender not only identifies Fibonacci levels but also provides a customizable framework where you can adjust anchor points, colors, and level visibility to suit your trading strategy. This customization allows traders to tailor the indicator to fit different market conditions and personal preferences.

Key Features of FibExtender

FibExtender offers several features to make Fibonacci level analysis easier and more effective. Here are some highlights:

- Automated Fibonacci Level Identification: The script automatically detects recent swing lows and pivot points to anchor Fibonacci extensions, allowing you to view potential resistance levels with minimal effort.

- Customizable Fibonacci Levels: Users can adjust the specific Fibonacci levels they want to display (e.g., 0.618, 1.0, 1.618), enabling a more focused analysis based on preferred ratios. Each level can be color-coded for visual clarity.

- Dual Anchor Points: FibExtender allows you to choose between anchoring levels from either the last pivot low or a recent swing low, depending on your preference. This flexibility helps in aligning Fibonacci levels with key market structures.

- Transparency and Visual Hierarchy: FibExtender automatically adjusts the transparency of levels based on their "sequence age," creating a subtle visual hierarchy. Older levels appear slightly faded, helping you focus on more recent, potentially impactful levels.

- Connection Lines for Context: FibExtender draws connecting lines from recent lows to pivot highs, allowing users to visualize the price movements that generated each Fibonacci extension level.

Step-by-Step Guide for Beginners

Let’s walk through how to use the FibExtender [tradeviZion] script on a TradingView chart. This guide will ensure that you’re able to set it up and interpret the key information displayed by the indicator.

Step 1: Adding FibExtender to Your Chart

- Open your TradingView chart and select the asset you wish to analyze.

- Search for “FibExtender [tradeviZion]” in the Indicators section.

- Click to add the indicator to your chart, and it will automatically plot Fibonacci levels based on recent pivot points.

Step 2: Customizing Fibonacci Levels

- Adjust Levels: Under the "Fibonacci Settings" tab, you can enable or disable specific levels, such as 0.618, 1.0, or 1.618. You can also change the color for each level to improve visibility.

- Set Anchor Points: Choose between "Last Pivot Low" and "Recent Swing Low" as your Fibonacci anchor point. If you want a broader view, choose "Recent Swing Low"; if you prefer tighter levels, "Last Pivot Low" may be more suitable.

- Fib Line Length: Modify the line length for Fibonacci levels to make them more visible on your chart.

Step 3: Spotting Visual Clusters (Manual Analysis)

- Identify Potential Resistance Clusters: Look for areas on your chart where multiple Fibonacci levels appear close together. For example, if you see 1.0, 1.272, and 1.618 levels clustered within a small price range, this may indicate a stronger resistance zone.

- Why Clusters Matter: Visual clusters often signify areas where traders expect heightened price reaction. When levels are close, it suggests that resistance may be reinforced by multiple significant ratios, making it harder for price to break through. Use these clusters to anticipate potential pullbacks or consolidation areas.

Step 4: Observing the Price Action Around Fibonacci Levels

- As price approaches these identified levels, watch for any slowing momentum or reversal patterns, such as doji candles or bearish engulfing formations, that might confirm resistance.

- Adjust Strategy Based on Resistance: If price hesitates or reverses at a clustered resistance zone, it may be a signal to secure profits or tighten stops on a long position.

Advanced Insights (for Intermediate to Advanced Users)

For users interested in the technical workings of FibExtender, this section provides insights into how the indicator functions on a code level.

Pivot Point and Swing Detection

FibExtender uses a pivot-high and pivot-low detection function to identify significant price points. The upFractal and dnFractal variables detect these levels based on recent highs and lows, creating the basis for Fibonacci extension calculations. Here’s an example of the code used for this detection:

// Fractal Calculations

upFractal = ta.pivothigh(n, n)

dnFractal = ta.pivotlow(n, n)

By setting the number of periods for n, users can adjust the sensitivity of the script to recent price swings.

Fibonacci Level Calculation

The following function calculates the Fibonacci levels based on the selected pivot points and applies each level’s specific ratio (e.g., 0.618, 1.618) to project extensions above the recent price swing.

calculateFibExtensions(float startPrice, float highPrice, float retracePrice) =>

fibRange = highPrice - startPrice

var float[] levels = array.new_float(0)

array.clear(levels)

if array.size(fibLevels) > 0

for i = 0 to array.size(fibLevels) - 1

level = retracePrice + (fibRange * array.get(fibLevels, i))

array.push(levels, level)

levels

This function iterates over each level enabled by the user, calculating extensions by multiplying the price range by the corresponding Fibonacci ratio.

Example Use Case: Identifying Resistance in Microsoft (MSFT)

To better understand how FibExtender highlights resistance, let’s look at Microsoft’s stock chart (MSFT), as shown in the image. The chart displays several Fibonacci levels extending upward from a recent pivot low around $408.17. Here’s how you can interpret the chart:

- Clustered Resistance Levels: In the chart, note the grouping of several Fibonacci levels in the range of $450–$470. These levels, particularly when tightly packed, suggest a zone where Microsoft may encounter stronger resistance, as multiple Fibonacci levels signal potential barriers.

- Applying Trading Strategies: As price approaches this clustered resistance, traders can watch for weakening momentum. If price begins to stall, it may be wise to lock in profits on long positions or set tighter stop-loss orders.

- Observing Momentum Reversals: Look for specific candlestick patterns as price nears these levels, such as bearish engulfing candles or doji patterns. Such patterns can confirm resistance, helping you make informed decisions on whether to exit or manage your position.

Conclusion: Harnessing Fibonacci Extensions with FibExtender

FibExtender [tradeviZion] is a powerful tool for identifying potential resistance levels without the need for manual Fibonacci calculations. It automates the detection of key swing points and projects Fibonacci extensions, offering traders a straightforward approach to spotting potential resistance zones. For beginners, FibExtender provides a user-friendly gateway to technical analysis, helping you visualize levels where price may react.

For those with a bit more experience, the indicator offers insight into pivot points and Fibonacci calculations, enabling you to fine-tune the analysis for different market conditions. By carefully observing price reactions around clustered levels, users can identify areas of stronger resistance and refine their trade management strategies accordingly.

FibExtender is not just a tool but a framework for disciplined analysis. Using Fibonacci levels for guidance can support your trading decisions, helping you recognize areas where price might struggle or reverse. Integrating FibExtender into your trading strategy can simplify the complexity of Fibonacci extensions and enhance your understanding of resistance dynamics.

Note: Always practice proper risk management and thoroughly test the indicator to ensure it aligns with your trading strategy. Past performance is not indicative of future results.

Trade smarter with TradeVizion—unlock your trading potential today!

הערות שחרור

FibExtender [tradeviZion] - Updated for Pine Script Version 6הערות שחרור

FibExtender V3.0: Bi-Directional Fibonacci ExtensionsRelease Notes - May 19, 2025

- Added downward Fibonacci extensions to complement upward extensions - now showing potential support levels below price

- New direction options: 'Up', 'Down', or 'Both' to control which extensions are displayed

- Fixed display issues with Fibonacci labels

- Renamed anchor points for clarity ('Last Pivot' and 'Recent Swing')

FibExtender v3.0 expands the original functionality by adding downward Fibonacci extensions, allowing traders to simultaneously visualize both potential resistance levels above price and support levels below.

Code Sample

// Direction setting

fibDirection = input.string('Both', 'Fibonacci Direction',

options = ['Up', 'Down', 'Both'],

tooltip = 'Choose direction for Fibonacci levels')

This script is for educational purposes only. Always conduct proper testing and risk management before trading.

הערות שחרור

FibExtender V4.0: Enhanced Price Filtering ControlRelease Notes - June 03, 2025

- Added optional price filtering toggle - "Filter Levels by Current Price"

- Filter ON (default): Shows only relevant levels (maintains V3 behavior)

- Filter OFF (new): Displays ALL Fibonacci levels for complete historical context

- Enhanced flexibility for both clean analysis and comprehensive market study

- Fully backward compatible with existing V3 setups

FibExtender v4.0 adds powerful filtering control, allowing traders to choose between focused analysis (relevant levels only) or complete Fibonacci structure visualization (all calculated levels). Perfect for both quick decision-making and in-depth market analysis.

Code Sample

// NEW V4 FEATURE: Price Filter Toggle

filterByPrice = input.bool(title = 'Filter Levels by Current Price', defval = true,

tooltip = 'When enabled, hides levels below current price for upward extensions and above current price for downward extensions')

// Enhanced filtering logic

if not na(level) and (filterByPrice ? level > close : true)

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

TradeVizion™

For our premium indicators! whop.com/tradevizion/

For our premium indicators! whop.com/tradevizion/

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

TradeVizion™

For our premium indicators! whop.com/tradevizion/

For our premium indicators! whop.com/tradevizion/

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.