PROTECTED SOURCE SCRIPT

ORDER BLOCKS

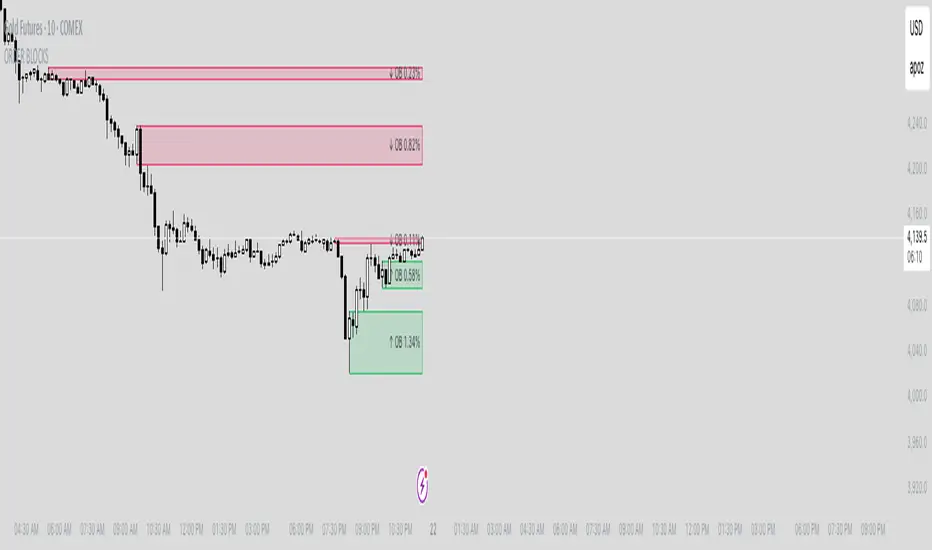

This indicator automatically detects and visualizes bullish and bearish order blocks using swing-based price action logic.

It’s designed for traders who focus on market structure, displacement, and institutional-style footprints (ICT-style logic) — without the clutter of overlapping or stale zones.

🧩 Core Logic

- Swing Structure Detection

- Identifies swing highs and lows using left/right candle logic to isolate structural turning points.

- Order Block Detection

- Bullish OB forms when price displaces upward after a swing low, confirming demand imbalance.

- Bearish OB forms when price displaces downward after a swing high, confirming supply imbalance.

- Mitigation Logic (Close-Through Deletion)

- Blocks remain active until price closes fully through the opposite side, at which point they’re considered mitigated and removed.

- No Overlap Enforcement

- Ensures order blocks never overlap in price range. When a new OB overlaps an older one, the older block is automatically deleted to keep the chart clean and structurally accurate.

⚙️ Features

- Customizable Swing Sensitivity (Left/Right Bars)

- Adjust how many candles define a swing high or low.

- Adjustable Lookback Range (Scan Back Bars)

- Determines how far back the script looks for valid OB setups.

- Dynamic OB Management

- Automatically extends valid blocks and removes broken ones.

- Visual Options

- Custom colors for bullish/bearish OBs and text labels showing candle range (%).

🧠 Trading Use

- Bullish OBs highlight potential demand zones or areas of institutional accumulation.

- Bearish OBs highlight potential supply zones or areas of institutional distribution.

- Once price closes through an OB, it’s considered mitigated — meaning the imbalance has been filled.

- Non-overlapping logic keeps only the most relevant, active zones for clean structure-based analysis.

📈 Ideal For

- ICT-style traders

- Smart money concepts (SMC)

- Price action structure traders

- Scalpers or swing traders using imbalance-based confluence

It’s designed for traders who focus on market structure, displacement, and institutional-style footprints (ICT-style logic) — without the clutter of overlapping or stale zones.

🧩 Core Logic

- Swing Structure Detection

- Identifies swing highs and lows using left/right candle logic to isolate structural turning points.

- Order Block Detection

- Bullish OB forms when price displaces upward after a swing low, confirming demand imbalance.

- Bearish OB forms when price displaces downward after a swing high, confirming supply imbalance.

- Mitigation Logic (Close-Through Deletion)

- Blocks remain active until price closes fully through the opposite side, at which point they’re considered mitigated and removed.

- No Overlap Enforcement

- Ensures order blocks never overlap in price range. When a new OB overlaps an older one, the older block is automatically deleted to keep the chart clean and structurally accurate.

⚙️ Features

- Customizable Swing Sensitivity (Left/Right Bars)

- Adjust how many candles define a swing high or low.

- Adjustable Lookback Range (Scan Back Bars)

- Determines how far back the script looks for valid OB setups.

- Dynamic OB Management

- Automatically extends valid blocks and removes broken ones.

- Visual Options

- Custom colors for bullish/bearish OBs and text labels showing candle range (%).

🧠 Trading Use

- Bullish OBs highlight potential demand zones or areas of institutional accumulation.

- Bearish OBs highlight potential supply zones or areas of institutional distribution.

- Once price closes through an OB, it’s considered mitigated — meaning the imbalance has been filled.

- Non-overlapping logic keeps only the most relevant, active zones for clean structure-based analysis.

📈 Ideal For

- ICT-style traders

- Smart money concepts (SMC)

- Price action structure traders

- Scalpers or swing traders using imbalance-based confluence

סקריפט מוגן

סקריפט זה פורסם כמקור סגור. עם זאת, אתה יכול להשתמש בו באופן חופשי וללא כל הגבלה - למד עוד כאן.

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.

סקריפט מוגן

סקריפט זה פורסם כמקור סגור. עם זאת, אתה יכול להשתמש בו באופן חופשי וללא כל הגבלה - למד עוד כאן.

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.