Today (December 10th, 2025), US federal reserve chair - Jerome Powell will speak at the FOMC Press Conference at 2 pm (NY timezone)

He will announce committee's decision to change the interest rate. Rather than speculating what he may say, lets look at a few basic economic principles in order to understand how it may impact the markets.

FUNDAMENTAL

Case A : They decide to cut the interest rate.

1. Interest rate goes down → Borrowing feels cheaper

2. Borrowing feels cheaper → Demand for money (here, USD) rises

3. Demand for money rises → Money printing (supply) increase

4. Money supply increase → Price of everything increases (over time) (rising inflation)

5. Rising inflation → USD weakens

6. USD weakens → Gold / Crypto strenthens

Case B : They decide to hike the interest rate.

1. Interest rate goes up → Less / No money printing

2. Less / No money printing → Limited money supply → Virtual scarcity

3. Virtual scarcity of money→Value of money (here, USD) strengthens

4. USD strengthens → Gold / Crypto weakens

Case C : They decide to keep the interest rate same.

Interest rate stays same → Continued Market Momentum

TECHNICAL

( All charts displayed as of 12/10/2025 4:00 (UTC-5) )

1. DOLLAR ( DXY )

DXY )

# 1-Day Long term bias : Bearish

# 1-Day Current phase : At POI in bearish consolidation with a possible double top

# 4-Hours' Trend : In a downtrend from its second top (from 1D timeframe)

# 4-Hours' Likely Liquidity Zone ; Sell-side sweep between 99.450-99.550

# 4-Hours' Projection : DXY likely to expand its current downtrend and fall further down atleast 98.650

2. GOLD ( XAUUSD )

XAUUSD )

# 1-Day Long term bias : Bullish

# 1-Day Current phase : At Possible High forming bullish continuation pattern

# 4-Hours' Trend : Sideways, forming a falling wedge pattern

# 4-Hours' Likely Liquidity Zone ; Buy-side sweep between 4150-4175

# 4-Hours' Projection : Gold likely to test / sweep support before expanding upside to atleast 4265

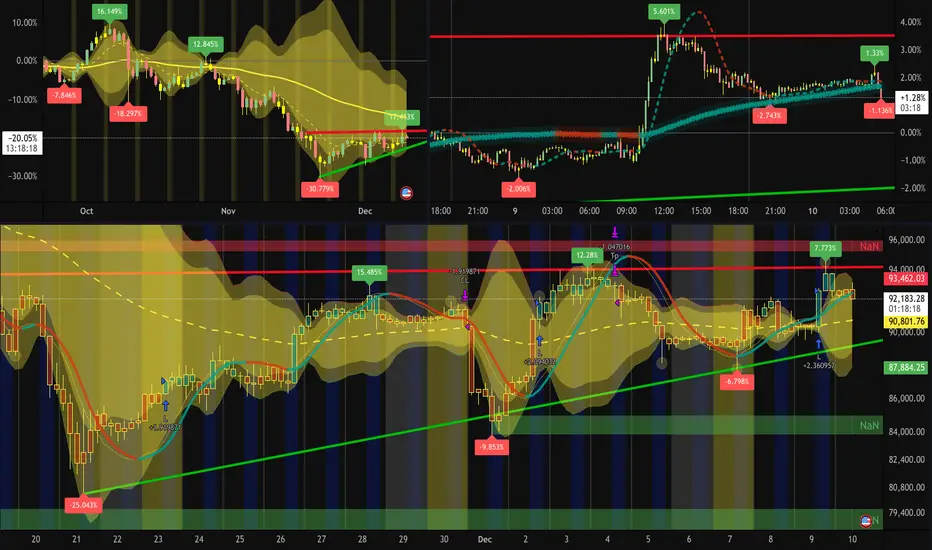

3. BITCOIN ( BTCUSD )

BTCUSD )

# 1-Day Long term bias : Bearish

# 1-Day Current phase : At Possible Low retracing back to its equilibrium (solid yellow line)

# 4-Hours' Trend : Sideways, forming a ABCDE Horizontal Triangle (as per Elliot Wave theory)

# 4-Hours' Likely Liquidity Zone ; Buy-side sweep at 88k / 83k | Sell-side sweep at 96k

# 4-Hours' Projection : Heavily likely to sweep both side during FOMC and start expanding upside to atleast 108k

4. SP500 / NASDAQ / DOW-JONES ( SPX )

SPX )

# 1-Day Long term bias : Bullish

# 1-Day Current phase : At Possible High retracing back to its equilibrium (dashed yellow line)

# 4-Hours' Trend : Uptrend, in disequilibrium with downside momentum

# 4-Hours' Likely Liquidity Zone ; Sell-side swept above 6870 | Buy-side liquidity at 6530

# 4-Hours' Projection : Likely to pullback to its equilibrium or stay stagnant before continuing its upside expansion to atleast 6950

Overall,

if the Fed decides to cut rate by 0.25%, market may show strong volatility

if the Fed decides to cut rate by 0.50%, market may show extreme volatility

if the Fed decided anything else, market stays stagnant with one-time hype volatility move

DXY likely to expand its current downtrend and fall further down atleast 98.650

Gold likely to test / sweep support before expanding upside to atleast 4265

Bitcoin likely to sweep both side during FOMC and start expanding upside to atleast 108k

SP500 likely to pullback to its POI or stay stagnant before its upside expansion to atleast 6950

He will announce committee's decision to change the interest rate. Rather than speculating what he may say, lets look at a few basic economic principles in order to understand how it may impact the markets.

FUNDAMENTAL

Case A : They decide to cut the interest rate.

1. Interest rate goes down → Borrowing feels cheaper

2. Borrowing feels cheaper → Demand for money (here, USD) rises

3. Demand for money rises → Money printing (supply) increase

4. Money supply increase → Price of everything increases (over time) (rising inflation)

5. Rising inflation → USD weakens

6. USD weakens → Gold / Crypto strenthens

Case B : They decide to hike the interest rate.

1. Interest rate goes up → Less / No money printing

2. Less / No money printing → Limited money supply → Virtual scarcity

3. Virtual scarcity of money→Value of money (here, USD) strengthens

4. USD strengthens → Gold / Crypto weakens

Case C : They decide to keep the interest rate same.

Interest rate stays same → Continued Market Momentum

TECHNICAL

( All charts displayed as of 12/10/2025 4:00 (UTC-5) )

1. DOLLAR (

# 1-Day Long term bias : Bearish

# 1-Day Current phase : At POI in bearish consolidation with a possible double top

# 4-Hours' Trend : In a downtrend from its second top (from 1D timeframe)

# 4-Hours' Likely Liquidity Zone ; Sell-side sweep between 99.450-99.550

# 4-Hours' Projection : DXY likely to expand its current downtrend and fall further down atleast 98.650

2. GOLD (

# 1-Day Long term bias : Bullish

# 1-Day Current phase : At Possible High forming bullish continuation pattern

# 4-Hours' Trend : Sideways, forming a falling wedge pattern

# 4-Hours' Likely Liquidity Zone ; Buy-side sweep between 4150-4175

# 4-Hours' Projection : Gold likely to test / sweep support before expanding upside to atleast 4265

3. BITCOIN (

# 1-Day Long term bias : Bearish

# 1-Day Current phase : At Possible Low retracing back to its equilibrium (solid yellow line)

# 4-Hours' Trend : Sideways, forming a ABCDE Horizontal Triangle (as per Elliot Wave theory)

# 4-Hours' Likely Liquidity Zone ; Buy-side sweep at 88k / 83k | Sell-side sweep at 96k

# 4-Hours' Projection : Heavily likely to sweep both side during FOMC and start expanding upside to atleast 108k

4. SP500 / NASDAQ / DOW-JONES (

# 1-Day Long term bias : Bullish

# 1-Day Current phase : At Possible High retracing back to its equilibrium (dashed yellow line)

# 4-Hours' Trend : Uptrend, in disequilibrium with downside momentum

# 4-Hours' Likely Liquidity Zone ; Sell-side swept above 6870 | Buy-side liquidity at 6530

# 4-Hours' Projection : Likely to pullback to its equilibrium or stay stagnant before continuing its upside expansion to atleast 6950

Overall,

if the Fed decides to cut rate by 0.25%, market may show strong volatility

if the Fed decides to cut rate by 0.50%, market may show extreme volatility

if the Fed decided anything else, market stays stagnant with one-time hype volatility move

DXY likely to expand its current downtrend and fall further down atleast 98.650

Gold likely to test / sweep support before expanding upside to atleast 4265

Bitcoin likely to sweep both side during FOMC and start expanding upside to atleast 108k

SP500 likely to pullback to its POI or stay stagnant before its upside expansion to atleast 6950

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.