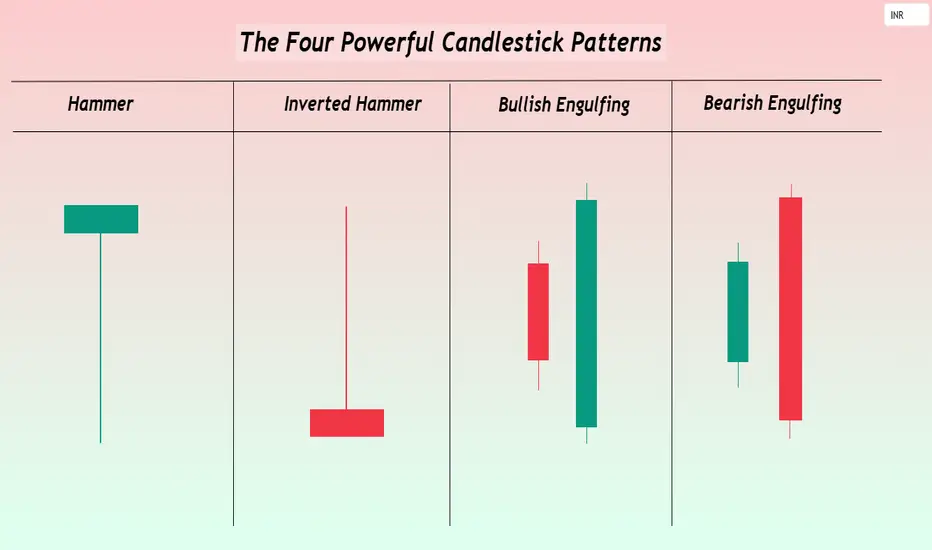

Hello TradingView Community and Friends here I am sharing the four of the most powerful candlestick patterns every trader should know especially to the new entrants to technical analysis and that are-: Hammer, Inverted Hammer, Bullish Engulfing, and Bearish Engulfing.

These patterns are not just visual shapes they reveal critical shifts in market sentiment and offer high probability trading opportunities when interpreted correctly.

I hope this article adds real value to your trading journey. Feel free to share your thoughts and experiences in the comments, sharing below the Four Powerful Candlestick Patterns.

1-Hammer: The Bullish Reversal Indicator Structure and Appearance-:

A small real body located near the top of the price range.

A long lower wick that is at least twice the size of the body.

Little or no upper shadow.

Psychology-:

During the session, bears push the price significantly lower, but bulls step in aggressively, driving the price back near the open.

The result is a strong potential bottoming signal showing that buyers are regaining strength.

Trading Strategy-:

Most effective after a steep downtrend or during oversold conditions.

Confirmation is essential: the next candle should close above the Hammer’s high to validate the reversal. A prudent stop-loss can be placed just below the low of the Hammer.

2-Inverted Hammer: a Subtle Bullish Rreversal signal, Structure and appearance-:

A small real body located near the bottom of the trading range.

A long upper wick that is at least twice the size of the body.

Very little or no lower shadow.

Psychology-:

Buyers attempt to push prices higher during the session but face selling pressure.

However the very presence of buying pressure after a downtrend hints at underlying bullish interest starting to emerge.

Trading Strategy-:

Most useful after a strong downtrend when signs of exhaustion appear.

The confirmation is again crucial a strong bullish candle following the Inverted Hammer gives a higher probability setup.

Risk can be controlled by placing a stop-loss below the Inverted Hammer’s low.

3-Bullish Engulfing: Buyers Taking Over Structure and Appearance-:

A large bullish (green) candle that completely engulfs the previous small bearish (red) candle’s body.

Ideally, the bullish candle opens lower and closes higher than the previous candle’s range.

Psychology-:

Initial selling pressure is absorbed and reversed with strong buying momentum.

A complete shift in sentiment from bears to bulls is reflected in the engulfing candle.

Trading Strategy-:

Most powerful when appearing after a sustained downtrend or at key technical support levels.

Traders often enter on a break above the Bullish Engulfing candle’s high.

Volume confirmation higher than average during the pattern significantly strengthens the signal.

4-Bearish Engulfing: Sellers Seizing Control, Structure and Appearance-:

A large bearish (red) candle that fully engulfs the previous small bullish (green) candle’s body.

Ideally, the bearish candle opens higher and closes lower than the previous candle’s range.

Psychology-:

An initial bullish attempt is overwhelmed by aggressive selling pressure.

Bears decisively regain control, warning of a potential downside move.

Trading Strategy-:

Highly effective when occurring after an extended uptrend or near strong resistance zones.

Traders can initiate short positions on the break below the Bearish Engulfing candle’s low, with stops placed just above the pattern’s high.

Increased volume during the engulfing candle boosts the credibility of the reversal.

Key Techniques for Trading These Patterns Successfully-:

Always wait for confirmation a single candle is never enough subsequent price action is critical.

Volume matters- Candlestick signals accompanied by a surge in volume are generally more reliable.

Focus on key price zones- Patterns occurring near major support, resistance, or Fibonacci levels have a much higher success rate.

Risk management remains supreme- No pattern guarantees success. Appropriate stop-loss placement and calculated position sizing protect against false signals.

Conclusion-:

The Hammer, Inverted Hammer, Bullish Engulfing, and Bearish Engulfing patterns remain among the most trusted tools in a trader’s arsenal.

They capture critical moments when the balance of power between buyers and sellers shifts often leading to strong follow through moves.

However even the most powerful candlestick setups require patience, discipline, and proper confirmation.

By mastering these patterns and integrating them into a well rounded trading plan, traders can anticipate key market moves, time their entries better, and ride trends with greater confidence.

Focus on learning the language of price, and the markets will start speaking to you more clearly.

Hope you like this publication.

Best regards-Amit

These patterns are not just visual shapes they reveal critical shifts in market sentiment and offer high probability trading opportunities when interpreted correctly.

I hope this article adds real value to your trading journey. Feel free to share your thoughts and experiences in the comments, sharing below the Four Powerful Candlestick Patterns.

1-Hammer: The Bullish Reversal Indicator Structure and Appearance-:

A small real body located near the top of the price range.

A long lower wick that is at least twice the size of the body.

Little or no upper shadow.

Psychology-:

During the session, bears push the price significantly lower, but bulls step in aggressively, driving the price back near the open.

The result is a strong potential bottoming signal showing that buyers are regaining strength.

Trading Strategy-:

Most effective after a steep downtrend or during oversold conditions.

Confirmation is essential: the next candle should close above the Hammer’s high to validate the reversal. A prudent stop-loss can be placed just below the low of the Hammer.

2-Inverted Hammer: a Subtle Bullish Rreversal signal, Structure and appearance-:

A small real body located near the bottom of the trading range.

A long upper wick that is at least twice the size of the body.

Very little or no lower shadow.

Psychology-:

Buyers attempt to push prices higher during the session but face selling pressure.

However the very presence of buying pressure after a downtrend hints at underlying bullish interest starting to emerge.

Trading Strategy-:

Most useful after a strong downtrend when signs of exhaustion appear.

The confirmation is again crucial a strong bullish candle following the Inverted Hammer gives a higher probability setup.

Risk can be controlled by placing a stop-loss below the Inverted Hammer’s low.

3-Bullish Engulfing: Buyers Taking Over Structure and Appearance-:

A large bullish (green) candle that completely engulfs the previous small bearish (red) candle’s body.

Ideally, the bullish candle opens lower and closes higher than the previous candle’s range.

Psychology-:

Initial selling pressure is absorbed and reversed with strong buying momentum.

A complete shift in sentiment from bears to bulls is reflected in the engulfing candle.

Trading Strategy-:

Most powerful when appearing after a sustained downtrend or at key technical support levels.

Traders often enter on a break above the Bullish Engulfing candle’s high.

Volume confirmation higher than average during the pattern significantly strengthens the signal.

4-Bearish Engulfing: Sellers Seizing Control, Structure and Appearance-:

A large bearish (red) candle that fully engulfs the previous small bullish (green) candle’s body.

Ideally, the bearish candle opens higher and closes lower than the previous candle’s range.

Psychology-:

An initial bullish attempt is overwhelmed by aggressive selling pressure.

Bears decisively regain control, warning of a potential downside move.

Trading Strategy-:

Highly effective when occurring after an extended uptrend or near strong resistance zones.

Traders can initiate short positions on the break below the Bearish Engulfing candle’s low, with stops placed just above the pattern’s high.

Increased volume during the engulfing candle boosts the credibility of the reversal.

Key Techniques for Trading These Patterns Successfully-:

Always wait for confirmation a single candle is never enough subsequent price action is critical.

Volume matters- Candlestick signals accompanied by a surge in volume are generally more reliable.

Focus on key price zones- Patterns occurring near major support, resistance, or Fibonacci levels have a much higher success rate.

Risk management remains supreme- No pattern guarantees success. Appropriate stop-loss placement and calculated position sizing protect against false signals.

Conclusion-:

The Hammer, Inverted Hammer, Bullish Engulfing, and Bearish Engulfing patterns remain among the most trusted tools in a trader’s arsenal.

They capture critical moments when the balance of power between buyers and sellers shifts often leading to strong follow through moves.

However even the most powerful candlestick setups require patience, discipline, and proper confirmation.

By mastering these patterns and integrating them into a well rounded trading plan, traders can anticipate key market moves, time their entries better, and ride trends with greater confidence.

Focus on learning the language of price, and the markets will start speaking to you more clearly.

Hope you like this publication.

Best regards-Amit

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.