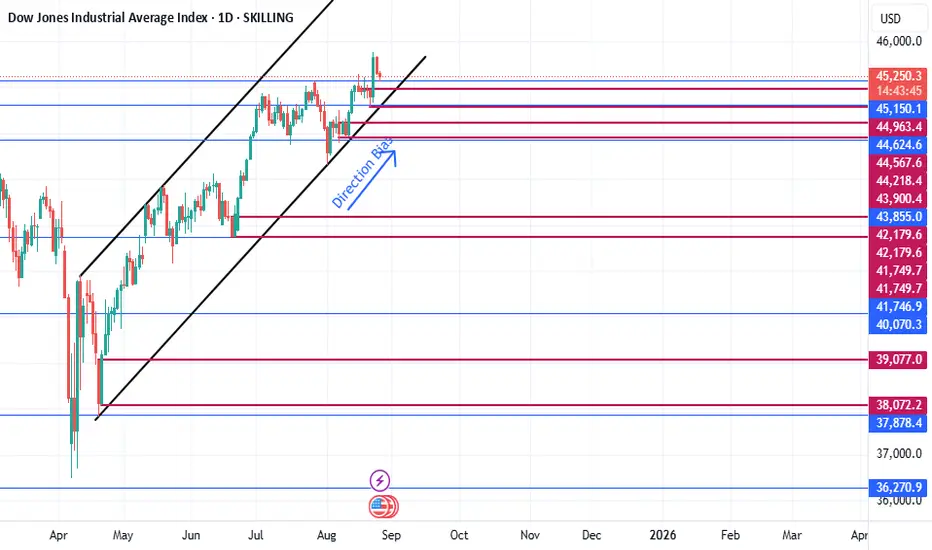

The US30 (Dow Jones) remains within a well-defined bullish channel, with recent price action rejecting the upper boundary around 45,350–45,261. This rejection looks like a liquidity grab above prior highs, a common SMC move before a deeper retracement. The nearest demand zone lies between 44,624 – 44,218, which coincides with an order block and previous consolidation. As long as price holds this zone, the market structure remains bullish, and longs targeting 45,261 and eventually 46,000 are favorable. A break below 43,855, however, would signal a market structure shift to bearish, opening downside targets at 42,179 – 41,746.

From a fundamental perspective, momentum is supported by expectations of a Fed rate cut before year-end to counter slowing growth, which generally boosts equity indices. Corporate earnings have surprised to the upside, helping maintain investor confidence. However, geopolitical risks—notably rising trade tensions between the US and China and instability in Eastern Europe—could spark risk-off sentiment, leading to sharp pullbacks. Additionally, the strong US dollar is pressuring exporters, which may weigh on the index in the short term.

Trade idea: Watch for a rejection and bullish confirmation in the 44,624–44,218 demand zone to enter long positions, with stops below 43,855 and targets at 45,261 and 46,000. If macro news worsens (e.g., escalation in geopolitical risks or hawkish Fed comments), and price breaks below 43,855, flip bias to shorts, aiming for 42,179 and possibly 41,746.

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.